The client

World leader in the insurance mediation business and in the field of risk consultancy. As a brokerage, its work focuses on mediating the relationship between large companies or groups and insurance companies. One of its fundamental objectives is to provide service to clients by turning uncertainty into opportunity and therefore, among other tasks, it acts as a mediator at the time of the claim.

The challenge

Despite being a leading company, policy management and claims tracking in Spain was done manually, using spreadsheets and email inboxes. So the day-to-day involved a flurry of paperwork that made it difficult to get the most out of work and value their contribution to the insured companies.

The challenge was to create a flexible claims management solution that could quickly and easily support new lines of business, products and customers. A dynamic technical solution had to be implemented that would be reflected in the user screens (claims data capture), in the online platform and in the business documentation that was generated in PDF format. No need for new software developments. To this, a configurable task engine had to be added to each business line, in order to standardize processes and make them more efficient.

In addition, complex integration work was carried out with insurance companies, in addition to shielding security and complying with data protection guidelines.

The solution

The Delonia team developed a digital platform that provided solutions to all business needs: management of policies, clients, companies, professionals,contracts, reinsurance, and comprehensive claims management.

Business lines became dynamically managed through metadata capable of interpreting information and acting accordingly,which was one of the keys to the project’s success. The addition or modification of an insurance product in terms of claim data capture, associated tasks and output documents is processed without the need for a software update, thanks to the parameterization provided by the system’s metadata.

Moreover, the system not only worked effectively, but was implemented in a short space of time.

The outcome

Thanks to the use of metadata, changes are implemented automatically and are reflected in each of the supports: database, on screen information or in the documents generated for the client. The agility of the solution makes database structure changes unnecessary, while the fields work automatically. It is also multi-language (Spanish, Catalan, Portuguese and English), adapted to the needs of a multinational company.

Claims management times were significantly reduced, in addition to gaining security by using a centralized solution and minimizing manual handling, allowing total control over administrative processes. On the other hand, having the data in a centralized system makes it possible for the main parties involved to access the situation of the claim in real time: clients, insurance companies, processors, supervisors, etc. This streamlines procedures and provides transparency of information that improves the perception of value by customers.

The company benefited from a solution that covers the entire range of claims management tasks and is kept up to date.

Increased customer valuation in the processing of their claims

2.3 out of 10

Together we can build a better future

Technology as a tool for progress

Contact us

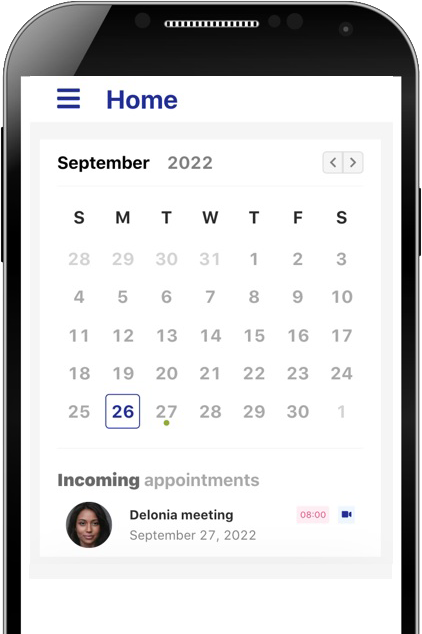

Schedule an appointment online

So that we can call you, make a video consultation or visit you at the time and through the channel you indicate.

© Delonia Software 2024

Services

Solutions

About Delonia

Follow us on LinkedIn

Co-financed

© Delonia Software 2024 | Privacy Policy | Legal Notice | Integrated System and Security | Whistle Blower Channel