On November 26, 2024, a conference was held at the Pérez-Lorca/IE Chair of Commercial Law on the impact of the AI in the Insurance Sector. It addressed the implications of the European Union’s AI Regulation on the insurance sector, and with it, what legal challenges we face and within what regulatory framework.

The event was developed in two expository groups, on the one hand to tell examples, use cases of how new technologies and models based on AI are helping insurance companies to make their processes more efficient and generate a better experience for their customers. On the other hand, to expose the legal questions that need to be answered, for example with regard to the civil liability involved in the use of these technologies.

David González Gallardo, Head of the Insurance Unit at Microsoft, presented several use cases. From his point of view we are living a real Gutenberg Moment, of radical change in the management of information thanks to the use of AI. This new era and the changes it implies will affect people, teams and industries, and in this context the role of lawyers and legal areas is fundamental.

One of the reasons why AI has made such an obvious push in recent times is that the upfront investment to generate these models is no longer as high as it was a few years ago. AI has been around for many years (it was actually born in 1956 at the AI Daitmouth Conference), only now its use has accelerated and become cheaper.

Specifically in the insurance industry, there are four areas where AI is adding value:

- Reinventing the customer relationship

- Redesigning business processes

- Enriching the employee experience

- Accelerating innovation with new business models

This can be developed on three main pillars:

- Modernize applications: many of the systems available to insurance companies date back to the 1980s. This technology is used to issue policies and manage claims, which is a barrier.

- Intelligent applications: that allow interaction with natural language.

- Co-piloting: artificial intelligence should help to be more effective, but the pilot should be the person.

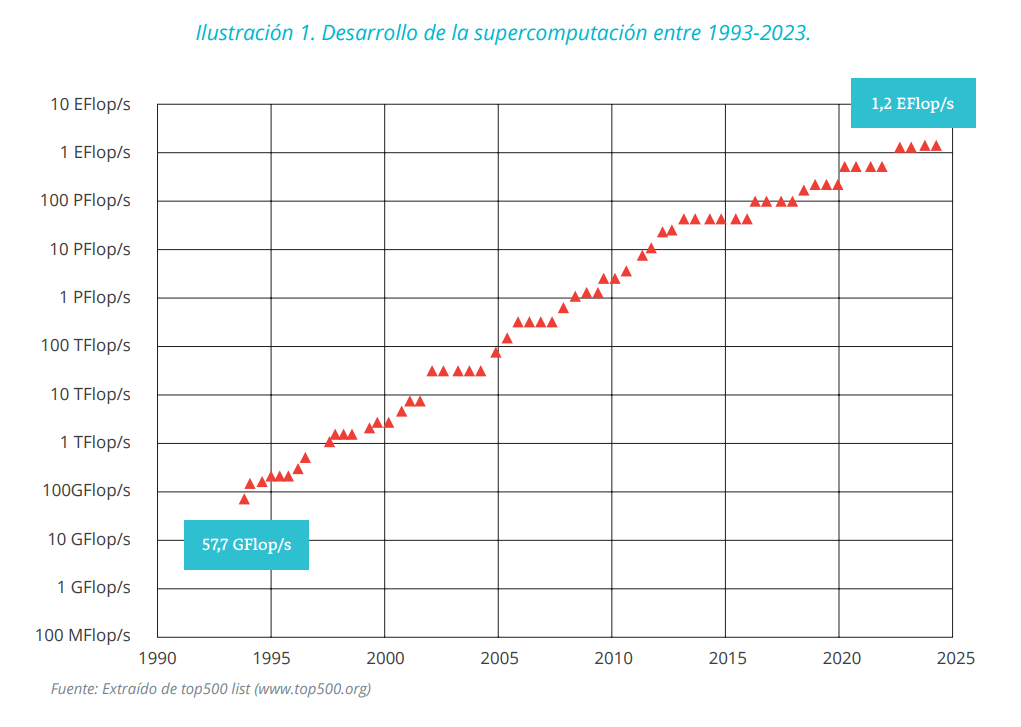

If it has been in operation for so long, why is it emerging just now?

- Because of the computing capacity that is multiplying by 2 every 2 years. In other words, we can process more and more information, giving AI systems more capacity to think.

- We are generating more and more data, more and more raw material, and this growth is expected to be exponential.

- Costs are lower, chips are getting more powerful and using them is cheaper. The cost of training a model has been reduced since 2017 by 99.5%.

In the insurance world, AI expertise has focused on four points:

- Improving the policyholder experience

- Empowering employees and agents

- Risk management

- Modernize core operations.

Araceli Moyá a lawyer specializing in Privacy at Sanitas, spoke with Raúl Rubio, partner of Intellectual Property, Industrial and Technology at Pérez-Llorca, about the legal challenges of AI. She raised the need for a deep legal analysis, but also a practical one, since they are facing a complex regulation that has to be implemented in insurance companies. Processes must be clear and have governance that works in the long term. Legal uncertainty must be avoided or minimized in the process.

Of course, the question was raised as to whether the European Union is over-regulating and whether this could slow down innovation with respect to other countries such as the USA or China. It does not have to be a brake, although it may slow down decision making. The legal system will have to integrate AI and at least initially there will be some overregulation.

Raúl Rubio pointed out that the data protection areas of companies will have a lot to say in the way AI is used, as the data protection regulation and its implementation is an important precedent. AI, business and compliance must go hand in hand.

Felipe Vázquez Insurance and Reinsurance partner at Pérez-LLorca and Rodrigo Fuentes Gómez, IE Law School professors and Director of People, Organization and General Secretary at Axa Spain, also presented some interesting ideas:

- How do I want to transform my company?

- Do I have quality data?

- What people do I count on? Do they have the capacity to transform?

- Regarding governance, how do we control the ethical use of data in AI?

There were also very interesting contributions from Joaquín Ruiz Echauri, Insurance and Reinsurance Partner at Pérez-Llorca, who noted the importance of high-risk AI systems, for example those used in health management, where caution must be exercised, although he also stressed that everything will be adjusted as the technological and judicial model adapts.

In short, AI will bring opportunities for insurance companies if their management systems and the data they have and collect are adapted to these new technologies and as long as they are subordinated to the company’s business strategy. On the other hand, the responsible use of AI requires a regulatory framework that encourages innovation while providing legal certainty for the parties involved.