The advent of the Internet in our lives has increasingly meant the digitization of aspects that until not so long ago were carried out entirely physically. Almost everything now has a digital version, for example, the process of ordering and paying for a cab ride. You can even leave a review about the driver to recommend him or not to future customers.

This trend has been increasing with the advent of mobile devices. The simple fact of having a device in your pocket on which you can receive information makes it more attractive for companies to digitize their services, and thus keep the customer up to date with the latest news.

For this reason, many companies have opted to create mobile applications or websites from which customers can view, order and even consume their products or services. In many cases, the aim is to improve the user experience by making the user feel more comfortable, so that he or she can access the application on a recurring basis. To this end, loyalty programs are often used in which the user is rewarded using a system of points that can be used as a means of exchanging branded products and services.

There are now alternatives for digitizing cards belonging to a physical wallet.

With these, not only can we offer loyalty programs to customers, but also store access passes to an event or place, discount coupons or even our credit cards. These alternatives offer greater convenience to the user and allow companies to perform actions that would be impossible with physical passes.

In this article we will review some use cases of these digital passes, and their potential advantages over a physical one.

Different types of digital cards

There are different types of passes, each one is used for a specific use case and has its own peculiarities when it comes to creating them:

Loyalty pass: they are used by businesses to create associate cards, in which it is possible to assign points to the owner in order to offer offers and promotions according to the number of points obtained.

Coupon pass: coupons are cards that can be redeemed; once redeemed, they can be automatically deleted. This type of card is usually accompanied by a bar code that can be scanned at the coupon issuer’s business.

Generic pass: this type of pass is used for different functions, hence its name.

They range from marketing cards, where there is information about our business, to identification passes such as, for example, a digital ID card.

Boarding passes: with these passes we can store information about a trip by train, bus or plane.

Specific information about the trip is stored: origin, destination, departure and arrival time and the passenger’s name.

Event pass: as its name suggests, it stores information about the event to be attended and data about the person attending the event.

This type of pass can be used for any event, from movies to concerts.

Advantages of including digital cards in a business

Digital passes offer several advantages when implemented in a business, both for the company and the user:

Advantages for the brand:

- Cost and infrastructure reduction: if a company already has a physical card issuing system, digitizing it could reduce costs by a large percentage.

Physical cards would no longer have to be sent to a recipient and material costs would be reduced by not having to create the physical card. If the company has one or more sites where passes are issued, digitizing these would only require a high availability server. - Elimination of borders: It is likely that, due to the situation in a country or other business reasons, it is impossible to deliver cards to a particular area. With digital passes this would no longer be a problem as long as certain characteristics are met by the customer.

- Closeness with the customer: it is possible to notify and warn the customer of changes in the business, offers or send reminders, which will strengthen the commercial relationship between the user and the brand.

Advantages for the customer:

- Greater convenience: the customer can access his passes on his mobile device where they do not take up physical space and are more manageable. If he decides to change device, he could have the passes associated with his account and use them without having to transfer any information. In addition, a pass is prevented from deteriorating over time to the point of becoming invalid.

- Loss and theft are avoided: it is quite common for a card or wallet to be lost or stolen.

With digital passes, even if the device where they are stored is stolen, if the pass is associated to the account or stored in another external service, it will not be lost. - Closeness to the business: the customer can receive interesting notifications about offers, important changes or reminders.

Are there any disadvantages to including this model in a business?

Not many, but there is always some risk in strategy changes. For the company, it could involve a one-off increase in costs and difficulties in adapting, although the risks can be minimized if the change is approached in a planned manner and within the appropriate timeframe.

The other difficulty comes from the end user, those customers who do not have access to the Internet or a cell phone, who are not accustomed to using technological resources, or who do not take advantage of them by, for example, not activating notifications.

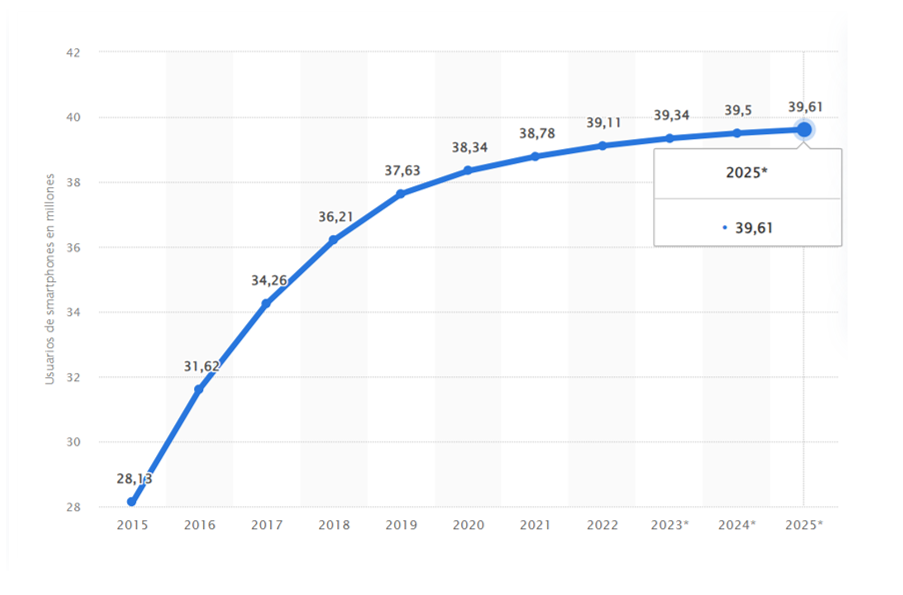

This group, however, is becoming smaller and smaller if we take into account that in Spain 82% of the population uses a smartphone.

Digital passes could change the way businesses communicate with customers. It is important to know their possibilities and the doors they open to companies. On the other hand, it is necessary to perform an analysis prior to implementation in order to implement it efficiently, reducing risks and problems, in addition to ensuring that all customers have access to it.