1. Digitalization of pet insurance

We digress from the description of the digital health services platform to describe how all the concepts we have been dealing with are perfectly extrapolable to Animal Health management.

If the process of digitalization of human health is slow and still underdeveloped in many aspects, in the world of pets this situation is worse. In this case, there are hardly any developments worth mentioning. Progress in this regard is very much restricted to the professional world of livestock farms, in fact, one of the recurrent protests of this sector is the excess of bureaucracy, aggravated by the imposition of pseudo-digital systems that are very difficult for them to use. The management of information technology in the agricultural sector would require a deep reflection and a very fine design where usability would be the main focus.

Without going into the problem of farms and focusing on companion animals, we are going to approach this subject in a couple of articles:

- The first, the one you are reading now, focuses on defining the basic concepts.

- The second will describe in more detail the possible digital services to be implemented.

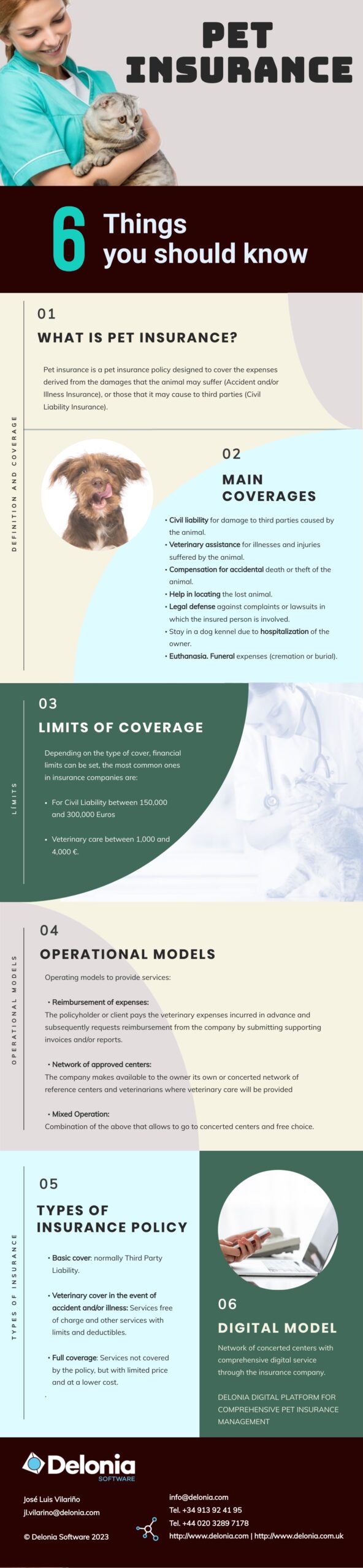

2. Conceptual Basis of Pet Insurance

Pet insurance is an insurance policy for pets intended to cover the expenses derived from damages that the animal may suffer (Accident and/or Illness Insurance), or those that may be caused to third parties (Civil Liability Insurance).

The main coverages offered by this type of insurance are:

- Civil liability for damages to third parties caused by the animal.

- Veterinary assistance for illnesses and injuries suffered by the animal

- Compensation for accidental death or theft of the animal.

- Help in locating the stray animal.

- Legal defense against complaints or lawsuits in which the insured party is involved as the owner of the animal.

- Stay in a kennel due to the owner’s hospitalization.

- Euthanasia.

- Funeral expenses (cremation or burial).

Normally, insurance products are combinations of the above coverages together with economic limits and/or deductibles.

3. Limits

Depending on the type of coverage, economic limits may be set, the most common in insurance companies are:

- For Civil Liability between 150,000 and 300,000 euros.

- Veterinary assistance between 1,000 and 4,000 euros.

In addition, some products sometimes include sliding scale prices for non-covered services and deductibles for higher cost services.

4. Operating Models

When it comes to providing services, there are basically two models:

- By reimbursement of expenses:

This is the simplest model. The policyholder or client pays the veterinary expenses in advance and subsequently requests reimbursement from the company by submitting the invoices and/or supporting reports. The company assesses the documentation and, if applicable, reimburses the expenses, usually a percentage of the same depending on the type of policy contracted.

- Through a network of approved centers:

The company provides the policyholder with its own network of centers and veterinarians where veterinary care will be provided. If the service is authorized by the insurance company, the customer does not have to pay for the service. Subsequently, the professional will invoice the services rendered directly to the company, which will proceed to pay for them.

There is a mixed operation, a combination of the previous ones, which allows the patient to go to both subsidized and free-choice centers, the difference being that in the free-choice centers, the service is always paid for in advance and then reimbursement is requested.

5. Types of policies

There is a very wide range of policies and coverages on the market and, in fact, no two policies are alike. In an attempt to summarize, we could group hedges into three types:

- Basic Coverage: normally, Third Party Liability.

- Veterinary coverage in case of accident and/or illness: includes some services at no cost (e.g. consultations, vaccinations and incineration) and other services with limits and deductibles (e.g. surgeries).

- Complete coverage: In addition to the above, it includes a list of services not covered by the policy, but with a limited price and at a lower cost than those offered to the client privately (without insurance). The discount is usually between 10-20%. In the latter case, services are always paid directly to the provider.

.

6. Digital model Network of approved centers

Currently, there is no company that has a connected, digital network of centers. Usually, the client is provided with a list of reference centers with telephone numbers and addresses to make an appointment. Once at the center, services not covered by the policy must be paid directly to the professional.

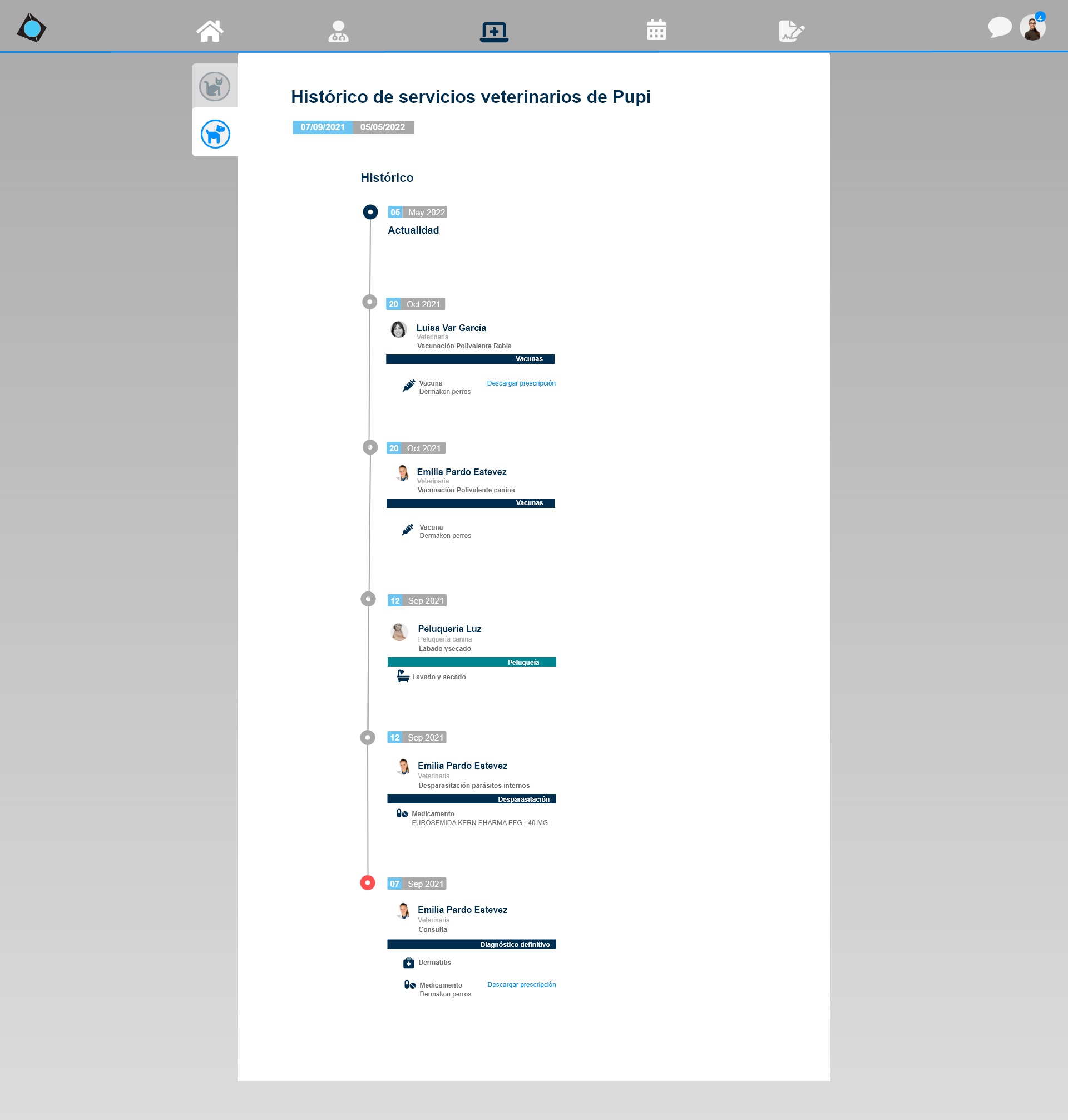

There is also no common record of the services performed on the pet that can be consulted by the owner or the professional, i.e. a digital veterinary record book.

Our model and platform solves this problem and provides a completely new digital experience, based on the following tools that the client can use through its app/web:

- Semantic search for symptoms or services.

- Online appointment with the providers in the chart (vs. phone call).

- Possibility of video-consultation.

- Digital prescription of services.

- Possibility of payment of services to the Company and subsequent settlement to the provider.

- Online Authorizing Center.

- Registration of the pet’s services accessible online (DIGITAL VETERINARY CARD).

- Management of services independent of their financing (in coverage, with co-payment or sliding scale).

In the next article we will detail some of these services to address the definitive digitalization of this type of insurance, for which there are currently few solutions on the market.